Motorpoint Bryce Dooley

LON: MOTR http://www.bdcapital1.com

Price £3.60 brycedooleybiz@gmail.com

Market Cap £325m Twitter: @BDools2

Long

Motorpoint is the leading independent omni-channel retailer of used cars in the UK. The company doesn’t rely on any single OEM brand and focuses on retailing 0-3 year old cars with less than 30,000 miles. Motorpoint also operates auction4cars.com, its online wholesale business, which allows it to buy and sell cars that fall outside of its retail criteria.

As an independent car supermarket, Motorpoint is able to sell any make of vehicle without the traditional expensive showrooms and operating mandates that are put on franchised dealerships by their respective OEM. Motorpoint has developed its own brand as a trusted dealer of quality used vehicles, with an operating model focused on low overhead and high turnover in order to provide low prices.

The business model focuses on key factors that drive consumer buying decisions and generate repeat customers:

- Choice. Used cars differentiate as they age. Make, model, age, mileage, features, modifications, condition, and price-point all make each used car unique in some way. For consumers looking for a specific car or price, Motorpoint has 4,000 to 6,000 vehicles in stock at any given time that it can transfer throughout the UK, and they turn this inventory every 30-40 days.

- Value. As the largest independent dealer, Motorpoint has the purchasing scale, volume, and cost leverage to pass savings to customers and offer the best prices on used cars 0-3 years old. This is evidenced by Motorpoint’s price promise. If a customer can find a like-for-like car within 7 days at a better price, they will refund the difference and provide a £50 Amazon voucher. In 2019, Motorpoint revealed that only 0.11% of 36,000 customers made a claim on the price promise. Additionally 92% of drivers in a survey said Motorpoint’s prices can’t be beaten. I will further detail their price advantage later on.

- Service. Motorpoint names itself the “Car Buyer’s Champion” by giving customers control to do things on their terms in a simple and easy process. Customers can buy how they want: online, in-store, online & pickup in store, same-day driveaway, and home delivery. Customers can also get ancillary products and financing. The entire process of buying a used vehicle can be done in-store or online at no-haggle. It’s a low-stress experience compared to a traditional dealership.

Management and Employees

Motorpoint’s greatest assets are the people that form its brand. Much of its strong financial returns are driven by brand, trust, and customer service that result in abnormally high volumes. Leading the company are CEO Mark Carpenter and Chairman Mark Morris who each own 10% of the shares (£30 million each). This ownership dwarfs the CEO’s annual compensation of £400,000, so he’s incentivized to drive long-term value in the stock.

Mark has been with the company for a decade and CEO since 2013. He promotes returning cost savings to customers through low-prices (think Costco) and does not manage to maximize short-term profit. This is a telling quote from the FY21 results call:

“Always making the product better, always investing in the customer. If I need to take a margin hit to make sure the product is the right thing that the customer wants, I will do that. Because providing that value and that excellent service and that high quality product is the most important thing for the long-term health of the business.”

Growth has been funded from cash flow, slow, and measured to perfect processes and teams in place at branches. Executive compensation was voluntarily reduced during the COVID lockdown in order to maintain lower-level employees at 100% pay. Mark Carpenter received a salary equivalent to minimum wage for two months. I think that speaks volumes to culture and the extent leadership is willing to go to for the long-term health of the business. Mark also meets with all new hires and frequently meets with teams throughout the company.

As a result, employees are highly engaged. Motorpoint placed 18th in The Sunday Times Best Large Company to Work for (made the top 100 the last seven years) and 1st in the Automotive sector. Employees become shareholders through the company’s share plan. Motorpoint trains and promotes from within, and also gives employees two paid-hours off each month to do something important to them. Team turnover has been reduced the last several years.

Engaged employees reduce bureaucracy and increase business adaptability. Employees are more open to trying new roles to best serve customers. This is evidenced by the home delivery rollout in 2020 that delivered 9,000 vehicles compared to zero in 2019. There appears to be a culture of happy, engaged, and invested employees that believe in the business and serving customers. This contributes to the “evolutionary survivability” of the organization and makes it more durable. This also leads to satisfied customers.

Customers

Motorpoint’s metrics for customer satisfaction are almost unheard of in the auto industry. H2 2020 Net Promoter Score (likelihood of a customer to recommend) reached an all-time high of 83%, up from 77% in 2018. This stacks up with Costco at 87%, Amazon at 87%, and Apple at 85% to show how well regarded the Motorpoint brand is. Average car dealership NPS is around 40%.

This satisfaction shows up in Motorpoint’s percentage of sales from repeat buyers, which also hit a high at 33%, up from 26% in 2017. This number has gradually risen because it takes several years for a first-time buyer to become a repeat buyer. The average repeat buy cycle is 3.5 years between vehicle purchases, so as Motorpoint’s branches and customer cohorts have matured past one or two repeat cycles, more and more buyers are coming back again.

Competitive Moat

I believe Motorpoint is able to offer the lowest prices and generate great cash returns on investment due to industry leading sales volumes that are a result of its brand reputation and customer trust. Volume driven by brand reputation cannot be bought by competitors or created from scratch. Motorpoint has built its brand and processes over the last 23 years and now has significant scale in its existing markets.

Evidence of this customer trust can be seen in the fact that 40% of cars Motorpoint sells are ordered sight unseen, and most of those are purchased without a test drive… that is 20,000 to 30,000 cars retailed each year either to a repeat buyer or without a test drive. A significant portion of customers clearly have a lot of trust in Motorpoint to get them a quality used car at the right price.

This is a similar model to CarMax in the U.S. However, Motorpoint takes volumes and pricing to an extreme that I believe makes its competitive position and earnings more durable than CarMax and the average business.

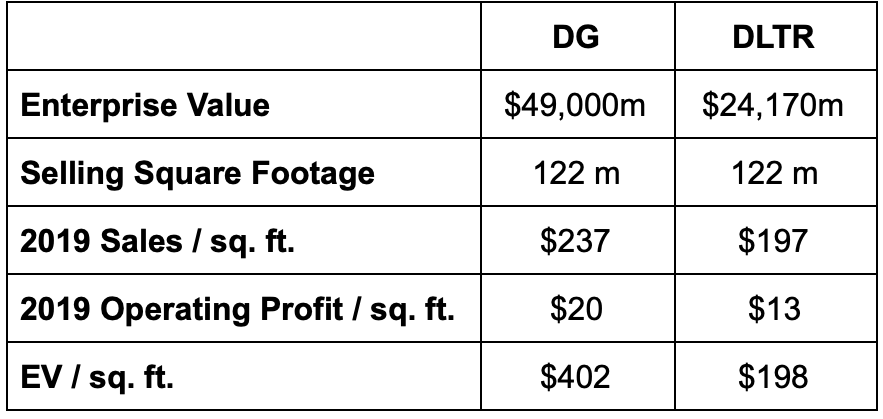

I think of this Motorpoint to Carmax comparison like a Costco to Wal-Mart comparison of retail models. Wal-Mart maintains competitive prices and an abundance of locations that are fairly accessible to the majority of the population. Costco, on the other hand, has fewer locations in major population hubs and absolute pricing authority thanks to high turnover and a reputation for quality goods at the lowest prices in a super-scaled warehouse format. Here are operating metrics that show the volume differences of Motorpoint and its similarities to Costco’s approach to retailing (all USD):

I believe this demonstrates that Motorpoint has taken the Costco model of a niche focus (0-3 year old vehicles), low gross margins, low overhead, and high turnover. This creates a virtuous cycle of happy customers returning for tremendous value, further increasing volumes and allowing for even better prices or profits at larger scale.

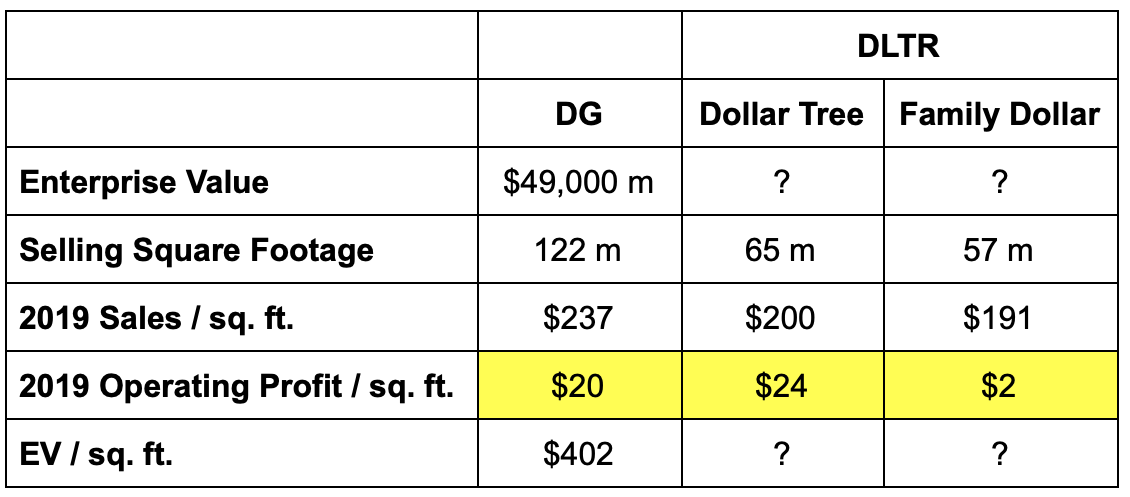

This competitive advantage not only allows Motorpoint to maintain a loyal customer base leading to more consistent future revenues, but also creates very high returns on invested capital from operating leverage on fixed costs – even at low gross margins. Here is an estimate of the typical mature Motorpoint store based on annual reports and comments from management. Also given is an example of the effect margins and operating profit if volumes were 25% lower, such as that of a CarMax store, or if Motorpoint did not have so many repeat buyers. Also shown are the estimated effects on the cost structure at lower volume. (All in £s)

As shown, the additional volume Motorpoint generates due to its brand increases mature operating margin by 50% and doubles operating profit at the store level. The incremental operating margin on the additional sales is over 5% compared to existing margins near 2%. This scale leads to return on store and prep center capex near 100%. These numbers can be checked against -30% revenue for FY21, when SG&A fell 12%.

Supply Advantage

A possible constraint to Motorpoint’s growth is their ability to source enough vehicle supply to meet a growing customer demand at attractive prices. They buy the majority of their vehicles from corporate fleets, leasing companies, leasing arms of OEMs, and auctions. OEM manufacturing economics support the continued supply of cheap vehicles into these secondary channels (albeit an ongoing hiccup due to COVID disruptions). From Motorpoint’s IPO prospectus:

“The use of secondary channels is attributed to the economics of car manufacturing, consisting of a high fixed cost base and relatively low marginal cost of production; together with the future income stream from parts supply. This results in OEMs being able to sell new vehicles to fleet managers and vehicle rental companies often at a significant discount to list price. The Group then purchases nearly-new vehicles from such fleet managers, vehicle rental companies and also the OEMs’ own leasing arms.”

Motorpoint has well-established relationships with these secondary vendors, with 9 of the top 10 supplier relationships spanning over ten years as of the 2016 prospectus. In 2015 they purchased from 280 different vendors.

Motorpoint is a critical player in the business model of these vendors. Motorpoint has scaled buying power and quick distribution which creates a strong sales outlet for vendors looking to get rid of vehicles (speed and price are the biggest factors in these transactions). On the FY2021 results call, CEO Mark Carpenter gave his expectation that they will continue to get supply because they stick to their prices, have the distribution to move vehicles quickly (scale & quick turnover), then be back to the vendor to buy more the next day. He stated that the product finds Motorpoint because they create sales run rate.

Additionally, Motorpoint is able to flex its buying criteria to expand its supply market or address vehicle shortages like the current COVID supply disruption. In the 2016 IPO prospectus, they highlighted their focus as 0-2 year old cars with under 15,000 miles. That focus has already changed today to 0-3 year old cars with under 30,000 miles. Starting this year they will also begin buying cars directly from consumers, even without a purchase from Motorpoint, which will open up more supply. This shows adaptability of the business model.

Finally, Motorpoint has established inventory financing relationships that enables them to source large deals and maintain over £100 million of inventory. These facilities aren’t available to smaller lots or startups that don’t have sales distribution, experienced vehicle acquisition processes, or extensive transaction value data.

Data Advantage

The lack of up-to-date, accurate market value data poses risks in used car retailing. Market values shift based on supply and demand. Inaccurate or old data can result in paying too much for vehicles as the market cools off or mispricing vehicles for retail. This has a significant effect on profit and cash flow when operating at low gross margins.

Motorpoint’s rapid inventory turnover gives it the most extensive information related to vehicle transaction values. They turn inventory an industry-leading 11x per year, and wholesale auction inventory every 14 days. During volatile market periods they are better equipped to read the market and protect gross margins. Buyers are better able to source vehicles at attractive prices and avoid overpaying when the market turns. The wholesale action business sells 30,000+ vehicles each year and is another source of data to Motorpoint’s advantage.

On the FY2021 results call, Mark Carpenter compared Motorpoints 11x inventory turnover to Cazoo’s “aspirational” 4x turnover and noted that the currently elevated used car market will correct at some point. He explained how Motorpoint will be in and out of the market before other players realize what’s happened to valuations and “catch a cold”.

Growth Opportunity

In the past, Motorpoint has taken a controlled growth approach targeting 20 stores (from 12 in 2019) with one new per year. With the market shift to online, rollout of a complete omni-channel offering, and increasing competition, they are now pedal to the medal to capture the current opportunity to take market share. The newly revealed growth strategy represents an acceleration and pivot.

Motorpoint is now creating a hub and spoke infrastructure model with large-scale vehicle preparation centers, 14 existing large showroom sites to maintain and retail inventory, and then 12 planned smaller “spoke” branches that will act primarily as sales outlets to bring Motorpoint closer to customers and improve logistics. 5 of the 12 new branches are already in advanced stages and will increase Motorpoint’s branch network from 14 to 19 rather quickly. These spoke branches will have lower volumes but capture incremental market share. Small sites are becoming available at attractive costs due to OEMs rationalizing their dealer networks and smaller dealers closing (increasing online and delivery market requires less physical infrastructure).

Added preparation sites will increase Motorpoint’s vehicle capacity from 100k to 200k. This will take preparation off of existing sites to achieve centralized prep scale and keep the stores sales oriented. The increased volume will leverage fixed costs and subsequently decrease prep costs per unit. FY21 was the first year with a prep center and decreased prep cost/unit from £213 to £198 even with significantly lower sales volumes. This number should go lower as these centralized hubs double vehicle throughput and leverage fixed costs.

The strategy behind the 12 new small branches is to increase the % of the UK population within 30 minutes of a Motorpoint branch. Currently, two-thirds of the population are within 60 minutes of a branch and Motorpoint has 6% market share of that cohort. They have found that customers are much less likely to put in effort and travel to find great value. This is evidenced by the key fact that Motorpoint has 10% market share of the customer cohort within 30 minutes of a branch. The new availability of smaller “spoke” sites will allow Motorpoint to increase the % of the population within 30 minutes of a site to 70-80%. Simply adding a branch to a region that didn’t previously have one takes market share from 3% to 10% in the first year. Physical brand presence in a market significantly increases share, and online-focused players are behind on this. In-store sales still represent over half of the market.

Relative to Motorpoint’s recent market share of around 4%, this growth strategy can result in a doubling of sales in the medium term and further growth long-term. Other evidence that Motorpoint’s UK market share has significant room to grow:

- Highest market share regions are at 25% share. These are stores #2 Burnley (2001) and #4 Newport (2005).

- Management has confirmed the older stores do ~£100 million in revenue. This compares to £88 million per store simple average for FY19 and £55-£60 million year one sales for new sites per the IPO prospectus. 4 of 14 stores are under five years old. Stores gradually ramp sales and market share as the repeat buyer cycle turns every 3.5 years.

- Branches over 8 yrs old have 13% market share, branches under 8 years old have 8% share. 7 of 14 Motorpoint branches are under 8 years old.

- On FY21 call Mark Carpenter stated that mid-teens share of the 1.5m unit market is possible.

The increased online penetration in the industry should result in accelerated consolidation towards large players in the next few years. A large marketing budget, brand awareness, and price transparency will drive traffic to websites with low prices and selection (Motorpoint). Small dealers will not be able to justify large IT and marketing expenditures, nor will they be able to match infrastructure efficiency of home delivery / vehicle transfer logistics. Motorpoint is the largest player in its segment by volumes and plans to ramp its marketing budget thanks to its cash generative business model. Newer entrants are burning cash in operations and using equity raises to create brand awareness. Motorpoint has already built its brand over the past 20 years.

Motorpoint is taking a CRM focus to marketing.They have over 800,000 unique customer email addresses in their database. These customer relationships have been developed over the past two decades of operations and are either not available or not as established to new entrants. Their goal with CRM marketing is to lower the repeat customer cycle from 3.5 years to 3.2 years. This increases transactions and the addressable market by 10%. Management says that excessive sponsorship marketing (Cazoo) is not a very effective use of marketing dollars once general brand awareness is achieved.

It’s likely that the percentage of sales to repeat customers figure, at maturity, is much higher than the 33% figure for sales in FY21. The repeat cycle is 3.5 years, so it takes years to increase that number even with high customer satisfaction. Two branches are under two years old and two others are under five years old. These branches drag the 33% repeat number down.

Marketing costs will impact margins over the next few years but I see these costs as investing through the income statement to capture the current opportunity. Some of the increase will be offset by lower prep/unit costs as prep centers scale up as discussed above.

I also expect gross profit to increase faster than sales due to increasing finance penetration online. This number has been lower than in-branch penetration but rising as Motorpoint develops its online sales model. From FY19 to FY21, online gross profit rose 43% while online volumes rose just 21%.

Valuation

Management is targeting £2 billion revenue and 2-3% EBIT margins by FY24. This translates to roughly 120k retail units (8-9% market share) and 80k wholesale units (5% market share). This revenue target is quite achievable given:

- Mature stores have market shares of 10-25%

- A significant increase in the population cohort within 30 minutes of a branch (10% market share) from the 12 new small branches

- Established, trusted brand + increased marketing efforts

- Another turn of the 3.5 year repeat buyer cycle

- Added direct-from-consumer wholesale supply and low auction fees

2-3% EBIT margins are achievable. Even operating subscale with growth expenses the past several years Motorpoint has been operating near a 2% margin. Gross profit can skew to the upside (above 8%) due to increasing finance penetration and improved pricing. Marketing costs will reduce margins in the short-term but I don’t expect a marketing war to develop long-term. These costs will be offset by efficiencies in vehicle prep and leveraging fixed SG&A costs on double the unit volume.

These targets would result in around £40 million net profit in FY24, almost all of which is free cash flow that can be distributed to shareholders. These numbers certainly have room to grow past the medium term, both beyond 8% market share and 2.5% EBIT margin. This is demonstrated by older store markets having 13-25% market share and mature branch economics at a 3% EBIT margin (mature branch revenue and gross profit to overheads ratio confirmed by CEO). Motorpoint can continue to grow finance penetration and ancillary products to add to margins over time. All of this is possible if Motorpoint maintains its brand reputation and delivers extreme value to customers, which management clearly intends to do.

Today’s enterprise value of £320 million is already up substantially from £230 million just two months ago (when 80% of these facts were available) yet still represents good value considering the business outlook. Management’s new strategy presentation has validated business progress and attracted interest in the stock since June.

Today’s market cap is 8 times expected FY24 cash flow. Over the next three years Motorpoint will also generate £15 to £25 million of free cash annually, at lower margins as they ramp to £2 billion in sales. This cash will be distributed to shareholders. Within two or three years I expect a double-digit free cash flow yield on today’s price. This is too cheap for an advantaged, growing business run by a strong management team, and a forward valuation outlook that is very difficult to find today. Relative to other growth/quality companies trading anywhere from 12 to 15 times three-years-out FCF, Motorpoint is at least 25% undervalued, and likely more given the economic durability and growth runway. With shareholder friendly buybacks and dividends, the rate of value compounding can be very attractive from recent valuations.

With a strong economic moat, customer proposition, and shareholder-aligned management team, I expect Motorpoint will be worth £500 to £600 million in 2024, with ~£50 million of dividends and buybacks until then, backed by roughly £40 million annual cash flow that should continue to grow with market share. Considering a range of outcomes with regards to exit multiples, capital return, and where margins settle, this should result in a probable 15% to 25% IRR over the medium term, and the upside potential for multiples of invested capital long-term.

Risks

- New online entrants like Cazoo and Cinch have significant capital from equity raises, larger marketing budgets, and may capture a disproportionate share of the market as it shifts online. I expect this to impact Motorpoint the least as it has a more comprehensive offering along with established operating processes.

I don’t expect a marketing war to develop and crush margins. Management stated that once general brand awareness is achieved, excessive sponsorship marketing is not very effective. Industry marketing should eventually settle down to instead focus on digital traffic, selection, and value. Also noted by management, everything that Cazoo is doing now has already been built by Motorpoint over the last twenty years. Motorpoint has cumulatively spent £100 million on marketing and sold over 400,000 vehicles at retail, developing best practices along the way. Cazoo is starting this now with a big budget and online focus. They lack the established processes and data that Motorpoint has.

I also don’t expect online-focused competitors will scale toe-for-toe with Motorpoint’s established physical presence. Management noted the geographic difference with regards to online-penetration in the UK. The south of the country is 65% online and 35% in-store, while the north is the opposite. In-branch sales are still a significant portion of the market. Motorpoint will capture a greater share of the in-store market and hold its own online thanks to wide selection and low prices.

- New car supply chain disruption due to COVID is causing a shortage of used inventory. This will likely reduce Motorpoint’s addressable market in the 0-3 year old vehicle segment and impact sales in the short-term. This is a transitory and not existential issue. Carpenter said they are willing to dip into the 3-4 year old segment to offset supply challenges. As shown already, the business model is adaptable to meet supply and demand changes and can flex inventory criteria.

Catalysts

- Low actively traded float. Insiders own 20% of the shares outstanding. Seven other investment funds combined own another 40% of the shares, and those are just the positions large enough to be disclosed in the annual report. I don’t believe these funds are selling anytime soon or near this valuation, and I also expect there are more long-term fund/individual shareholders beyond the 40% number. It’s likely that at least 70% of the shares outstanding are unwilling to sell their shares without a much higher valuation (myself included). Add the fact that Motorpoint has a buyback program in place (shares outstanding down 10% since 2018) which further reduces the available shares for incremental buyers and funds to build positions. Average daily volume is 0.08% of the market cap so it would take serious bidding for a buyer to build a material position in a reasonable amount of time.

- FY22 and FY23 market share and sales results from added branches.

- Capital return. Motorpoint plans to reinstate its dividend once there is further clarity to the current environment. They also expect to repurchase shares with excess capital.

- Relative valuation to Cazoo. Motorpoint has a better business model and is likely to post similar or better numbers in the coming years. Cazoo is being privately valued at £5 billion while Motorpoint trades at £320 million. I find this to be absurd.

Sources

Motorpoint filings/annual reports, exchange with management, FY21 results conference call